September 17, 2017

by Randell W. Martin, CPA

“No one… asked Equifax or its competitors, Experian Plc and TransUnion, to collect data about them. But unless you live off the financial grid, you have to accept that these companies you may know little about are keeping an eye on you and your reputation with creditors.”

– Bloomberg Businessweek, September 15, 2017.

There is a good chance that you’re one of the 143 million Americans whose sensitive personal data was compromised in Equifax’s recent data breach.

This 143 million equates to approximately three-quarters of the entire population of people who have credit reports—it is 44% of the population in the US.

According to Equifax, the breach lasted from mid-May to July and hackers got names, Social Security numbers, birth dates, addresses, and even driver’s license numbers. Furthermore the hackers also stole credit card number for 209,000 people and dispute documents for 182,000 people.

The disturbing thing is, regardless of if you have ever done business with Equifax or even ever communicated with them, they probably have your information anyway. It is frustrating to know that our personal financial data has been hacked from servers that we never gave it permission on which to reside. In any normal political season, this would most likely be something that politicians from both sides of the aisle take issue. It will be interesting to see how this plays out.

So the questions most Americans now have is if they were one of the 143 million or not. If it turns out that they are—what can they do about it? If not—how can they protect themselves the next time when they’re not so lucky?

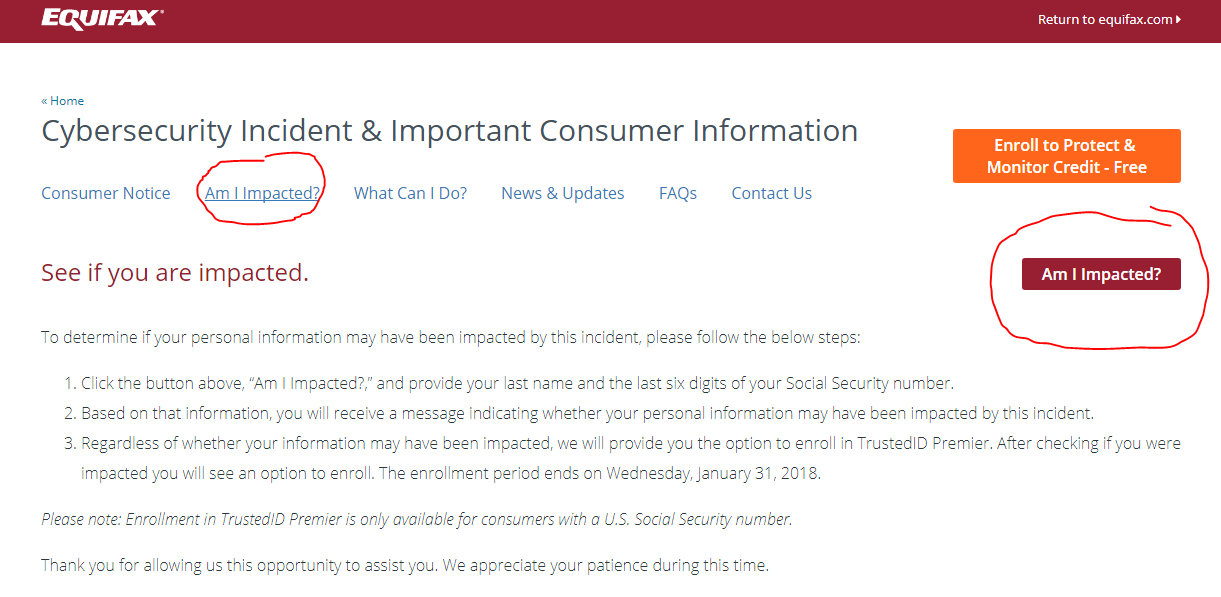

Equifax set up a site for user to check if they were affected by the breach. Simply go to www.equifaxsecurity2017.com and click on either of the “Am I Impacted?” links.

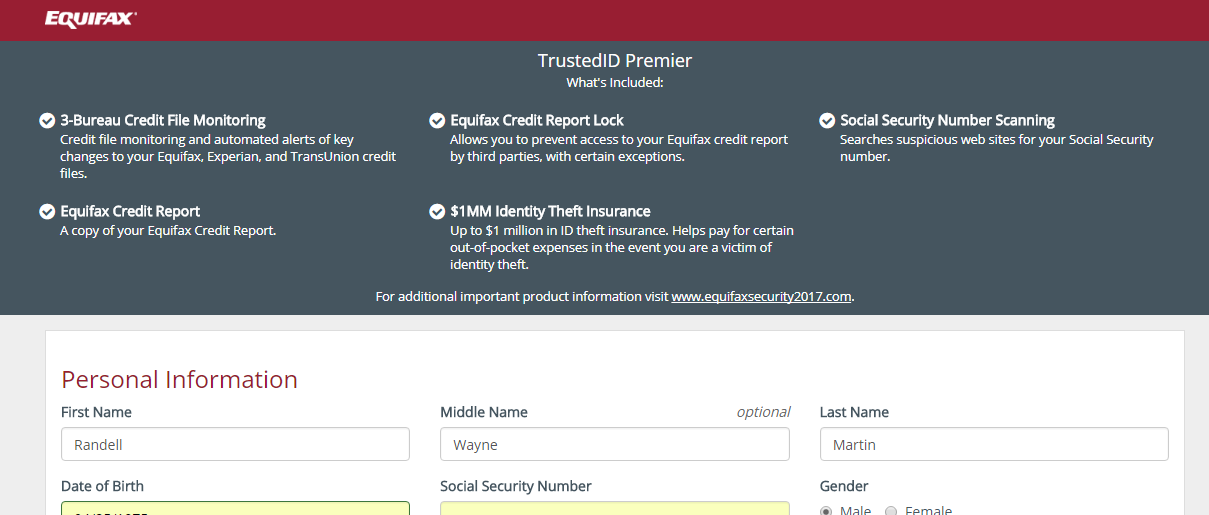

If you are impacted, you’ll get the option to sign up for a complimentary one-year credit monitoring service called “TrustedID Premier” after completing a short form shown below.

The Equifax “solution” for the individuals with compromised data however is only a fix for one year, and the service has been down due to high traffic for much of the time since Equifax implemented it.

Given this very weak fix provided by Equifax, we are encouraging our clients and consumers in general to take a few extra steps in order to protect themselves and their information.

- Check Your Credit Report. Equifax, Experian, and TransUnion all allow consumers to check their credit once a year for free. The easiest way to do this is by using www.annualcreditreport.com . Your current credit cards may also allow for a free credit service analysis to card holders.

- Place a Fraud Alert on Your File at the credit agencies. Everyone affected should do this; it costs nothing. Just simply call the agencies listed below and let them know that you were affected by the Equifax data Breach and you want a “Fraud Alert” placed on your file.

- Keep a close eye on your Bank Accounts and Credit Cards. Report any unusual activity immediately.

- Place a Credit Freeze or Security Freeze on your File. This option locks down your credit and makes it more difficult for identity thieves to open new accounts in your name. The credit agencies usually charge a $5-$10 fee for this service (to lock down your information they have which you never gave them permission to use). This is like the nuclear option.

- File your federal tax return ASAP! The breach gave the identity thieves everything they need to know in order to file your tax return and direct deposit any available refund.

Being more alert and following the above steps will help to mitigate the risk of data thieves exploiting your data they may already have. Check the Federal Trade Commission’s site below for other tips.

Contact each of the nationwide credit reporting companies:

- Equifax— 1-800-349-9960

- Experian— 1‑888‑397‑3742

- TransUnion— 1-888-909-8872

https://www.consumer.ftc.gov/articles/0497-credit-freeze-faqs